The Manufacturing Institute–BKD Small and Medium-Sized Manufacturers Survey

September 2021: The “New Normal” and Impacts on the Workforce

Read the Entire Report

Access the ReportOverview

This is the second in a series of special surveys of small and medium-sized manufacturers (i.e., those with fewer than 500 employees) that are being conducted by The Manufacturing Institute’s Center for Manufacturing Research and BKD, a national CPA and advisory firm. The topic will vary with each report, and for this survey, manufacturing leaders were asked to describe the “new normal” for their operations in the aftermath of severe disruptions due to the COVID-19 pandemic and to look at how disruptive technologies might have altered the worker profile or training requirements of the job. The MI and BKD administered this survey from Aug. 19 through Aug. 30 and received 302 responses. The survey was anonymous.

Highlights

- Workplace safety: Nearly 79% of small and medium-sized manufacturers have enhanced workplace safety measures and requirements since the COVID-19 pandemic began. In addition, firms reevaluated their supply chain, increased worker flexibility, instituted more remote work and reengineered their production processes with social distancing in mind.

- New normal: Many of the survey respondents reported additional workplace flexibility, with others noting supply chain and workforce challenges. At the same time, several companies noted that the changes they needed to implement have made them a stronger company and more prepared for future crises. Some respondents noted that their new normal is not much different from the old one or that it is too soon to tell.

- New workforce models: Since the beginning of the pandemic, companies have needed to adapt, with more work taking place remotely, understanding that much of the production process is not able to shift work away from the shop floor. Still, for those employees where it is possible, companies have shifted their perceptions of the value of remote work, and many see a hybrid model continuing post-pandemic.

- Return to work: More than 71% of respondents said their firms had not received any resistance or hesitance to returning to work, where working remotely was an option, with 18.4% saying they had faced some resistance.

- Transitioning the business: Nearly one-quarter of respondents said the pandemic had changed or heightened their desire to transition or sell their business. Of those who said this, 68.1% were working on a plan where they might not have before.

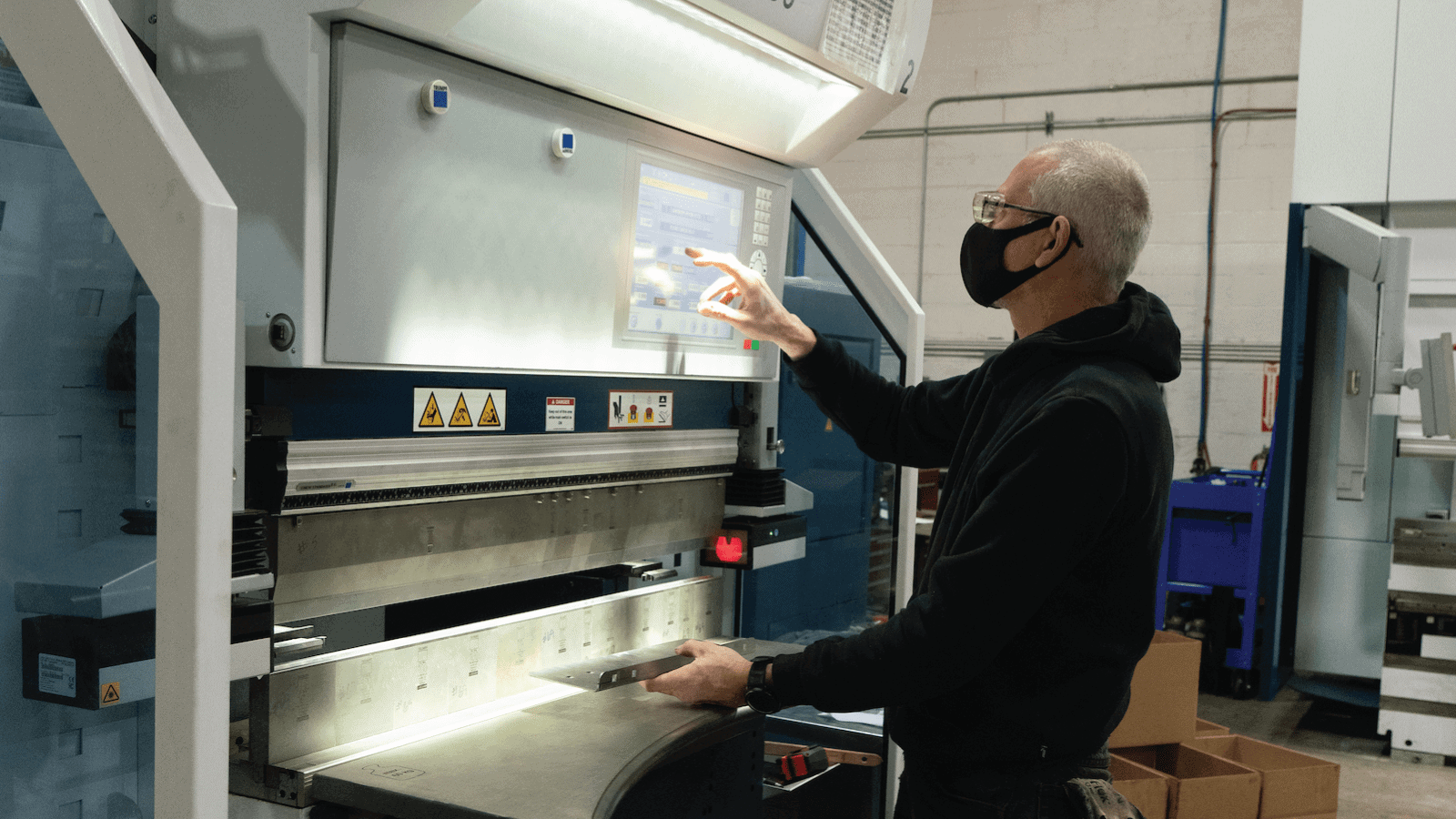

- Disruptive technology investments: One-third of SMMs had accelerated their investments in disruptive technologies since the pandemic began, with 61.4% noting that such investments were done to improve the operational performance in production. Other motivations included achieving greater efficiencies and to stay competitive with others in the industry. Worker shortages were also a factor.

- Worker needs in light of technology investments: Respondents offered free response comments, featured below, on both how the worker profile might change as a result of investment in disruptive technologies and how upskilling opportunities for existing employees might be altered.

Research Partners

Download the Entire Report